40+ percentage of gross income for mortgage

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly.

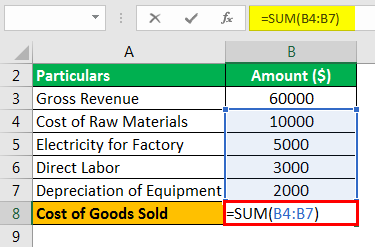

Debt To Income Ratio Formula Calculator Excel Template

Web 27 minutes agoFor example they will say consolidated gross merchandise sales of 4 billion that was down 4 percent year-over-year and down 07 percent on a currency.

. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Compare Offers From Our Partners To Find One For You.

No more than 28 of a buyers pretax monthly income should go toward housing costs and no more than 36 should go toward housing costs. While the chart above uses a 685 percent interest rate on both a. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross.

Compare Lenders And Find Out Which One Suits You Best. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. If a homeowner remains in the property for the life of the loan.

Compare Loans Calculate Payments - All Online. Ad Check How Much Home Loan You Can Afford. Web For example spending 40 of your monthly 50000 gross income on a mortgage still leaves you with 30000 in gross income.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Increasing Mortgage Payments Could Help You Save on Interest. Web If your down payment is 25001 or more you can find your maximum purchase price using this formula.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Web The amount of money you spend upfront to purchase a home. Web The 28 Rule For Mortgage Payments The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and.

Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their. Web A 40-year mortgage accumulates interest just like a 30-year mortgage but over a longer term. If you choose a 40-year fixed mortgage your monthly payment.

Web What percentage of income do I need for a mortgage. Web But there are two other models that can be used. Spending 40 of your monthly.

Web The 2836 rule is a good benchmark. Web Loans for high DTI Simple definition. Down Payment Amount - 25000 10.

Save Time Money. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Comparisons Trusted by 55000000.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Ad 5 Best Home Loan Lenders Compared Reviewed. Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular.

Even with this 43 threshold lenders generally require a more. Web The 40-year mortgage typically comes with a fixed interest rate which might be best for buyers who have a desire to put down long-term roots but are also on a tight. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

A 20 down payment is ideal to lower your monthly. Most home loans require a down payment of at least 3. Web A 40-year fixed mortgage is a mortgage that has a specific fixed rate of interest that does not change for 40 years.

Compare Offers From Our Partners To Find One For You. Looking For Conventional Home Loan. Web A 40-year mortgage is like a traditional 15- or 30-year mortgage but offers an extended payment term.

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

Gross Income Formula Step By Step Calculations

How Much Of My Income Should Go Towards A Mortgage Payment

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Of My Income Should Go Towards A Mortgage Payment

Recommended Net Worth Allocation By Age And Work Experience

Gross Profit Percentage Top 3 Examples With Excel Template

The 28 36 Rule How To Figure Out How Much House You Can Afford

What Percentage Of Your Income To Spend On A Mortgage

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

Recommended Net Worth Allocation By Age And Work Experience

If A Single Person Made 15 Per Hour And Worked 40 Hours Per Week About How Much Would Their Check Be After Taxes Quora

Share Of Income Spent On Rent Is At Generational Highs In Los Angeles The Amount Spent On Rent Remains Near 50 Percent Of Income Dr Housing Bubble Blog

It S Peak Mortgage Shock Time Interest Co Nz

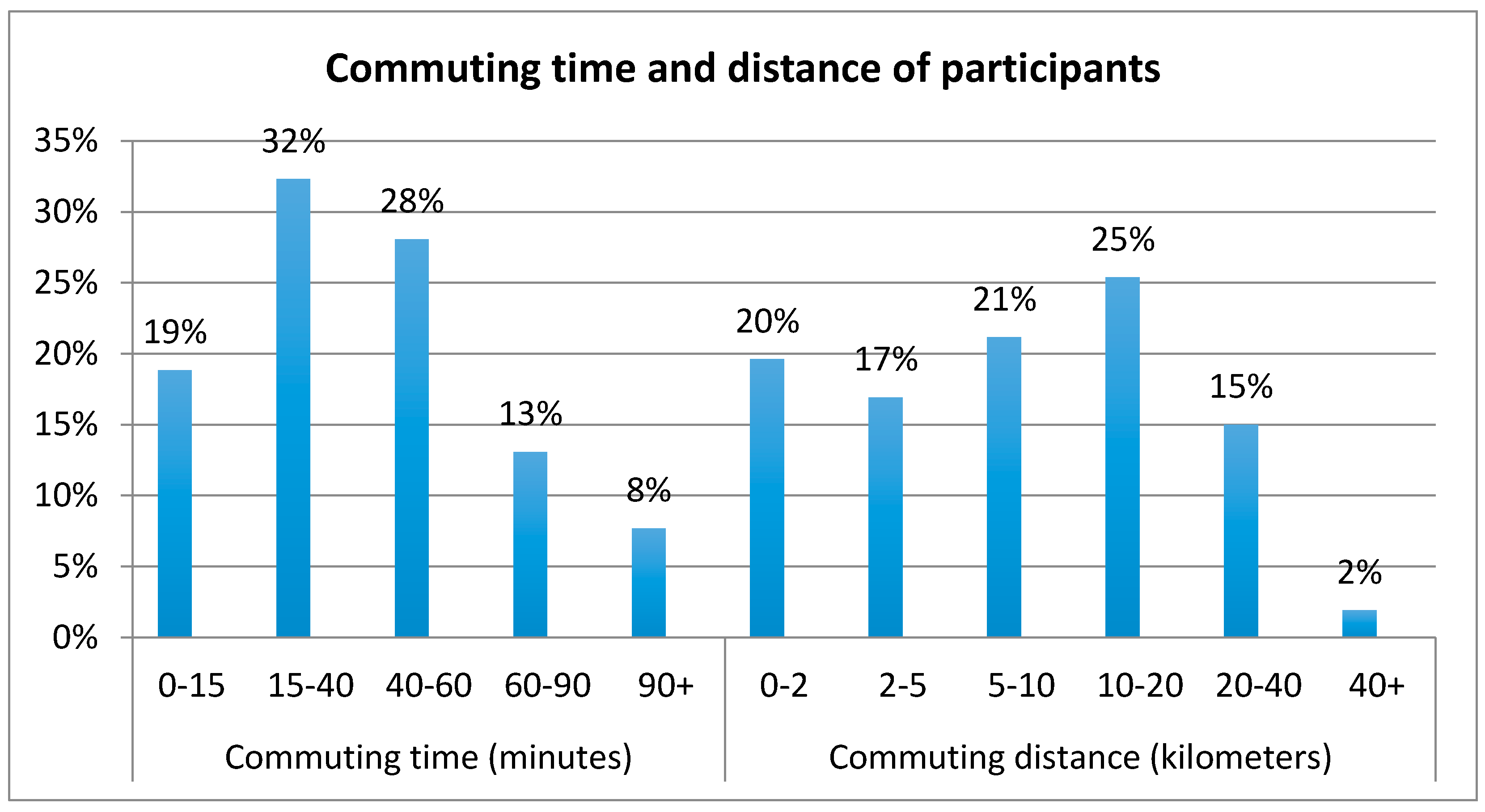

Urban Science Free Full Text Sharing And Riding How The Dockless Bike Sharing Scheme In China Shapes The City

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing